Giving

Make A Difference

As a not-for-profit, independent school, St. Joseph Academy depends on friends like you to provide an atmosphere of educational excellence and impact the lives of our students. The generosity of our community is as important today as it has been in the past. Your contributions enable us to recruit and retain the best faculty, provide tuition aid, continue to enhance our facilities, provide leading educational programs and more.

DESIGNER BAG BINGO

Join us for our upcoming Designer Bag Bingo on Saturday, March 7. This community event brings together families, friends, and supporters for a night of bingo and the opportunity to win designer handbags, while supporting the mission and programs of St. Joseph Academy. Whether you are a regular attendee or joining us for the first time, we look forward to welcoming you for an enjoyable evening and a chance to connect with the St. Joseph Academy community.

THE RISING

Join us for an evening of celebration and support at St. Joseph Academy's premier fundraising event, "The Rising"! Open to all friends, family, and esteemed alumni, this special gathering is a testament to our community's dedication to the values and spirit of SJA. Please join us at the beautiful and prestigious Tavistock Country Club on April 18th, as we honor a wonderful member of our community, Mr. Paul Ordille. This will be an unforgettable evening filled with camaraderie, entertainment, and opportunities to contribute to the continued success of St. Joseph Academy.

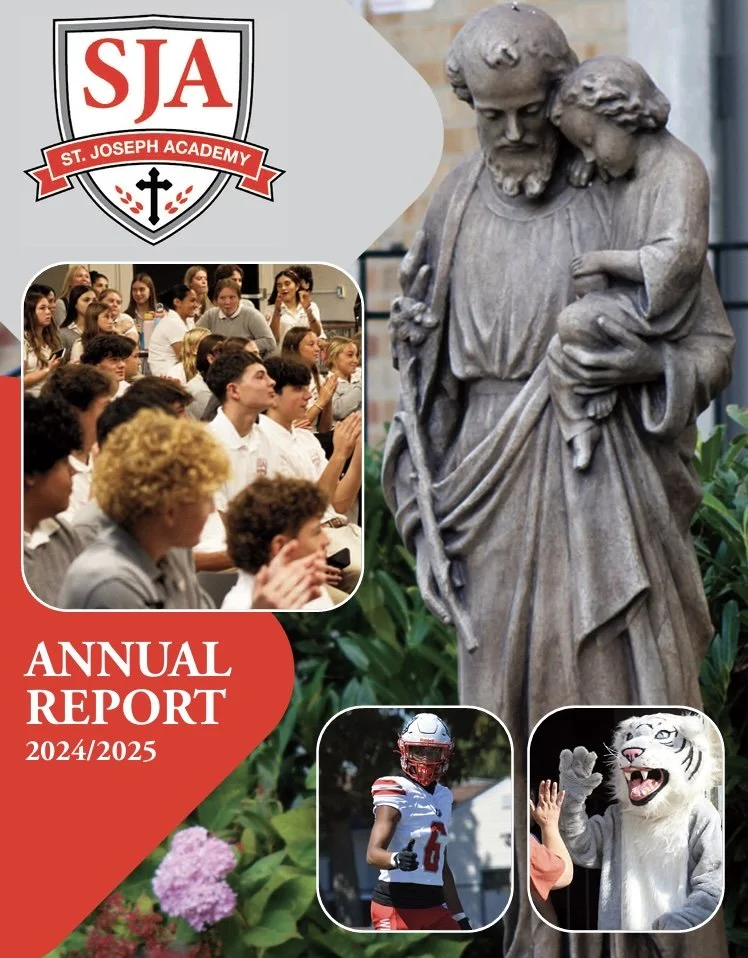

Introducing the 2024–2025 Annual Report

At St. Joseph Academy, each year tells a story — a story of growth, purpose, and the shared commitment that drives our mission of Faith, Family, and Future. Our 2025–2026 Annual Report brings that story to life by highlighting the accomplishments, milestones, and transformational moments that defined this school year.

This year’s report showcases the continued expansion of our academic and extracurricular programs, the steady rise in enrollment, the impact of our community partnerships, and the generosity of the families, alumni, donors, and local organizations who make our work possible. From innovative classroom experiences and major facility enhancements to the success of our student-athletes and the launch of new initiatives, the Annual Report reflects a year of meaningful progress for our students and our school.

We invite you to explore the report to see the difference your support makes every day. Thank you for helping us build a premier life-skills institution where students are empowered to grow, serve, and lead.

Benefits of Giving

-

When you donate appreciated stock (stocks that have increased in value since you purchased them), you avoid paying capital gains taxes that would normally be due if you sold the stock. Typically, if you sell appreciated stock, the gain is taxed at either short-term or long-term capital gains rates, depending on how long you've held the asset.

By donating the stock directly to SJA, you can sidestep these taxes and pass on the full value of the stock to the us!

-

You can claim a charitable deduction on your income tax return for the fair market value of the stock at the time of the donation (as long as you’ve held the stock for more than one year). This can help reduce your taxable income.

For example, Since SJA is a 503C charitable organization, if you donated $10,000 worth of stock, and you had purchased it for $5,000, you could deduct the $10,000 value from your taxable income.

-

The tax benefits are more favorable for stocks you’ve held for more than one year. These are considered long-term capital assets, and donating them directly to SJA allows you to deduct the full market value (as opposed to the lower cost basis, which would be the case if you sold the stock and then donated the cash).

As a 503C, donating stock to SJA can offer significant tax benefits, particularly for individuals looking to reduce their taxable income. Here are some key tax advantages of donating appreciated stock:

In addition to one-time donations, other giving options for your consideration include:

Endowment funding

Planned or estate gifts

Corporate matching gifts

Charitable or deferred gift annuities

Charitable lead trusts

Gifts of stock

Real estate gifts

Life insurance policies

Gifts in kind

Meet the Advancement Team

-

Mrs. Melissa Chesebro

Director of Advancement

Ext. 208

-

Mr. Stephen Cappuccio

Head of School / President

Ext. 201

By planning your gift, you can make significant contributions to our school while strategically meeting your financial goals. If you would like to discuss giving options in further detail, please contact Mrs. Melissa Chesebro, Director of Advancement, at mchesebro@stjoseph.academy or 609-561-8700 Ext. 205.

St. Joseph Academy (Federal Tax Id# 85-2381454) is a non-profit 501 (c) (3) organization. Current tax law requires this receipt letter must state the value of any goods, services, or other benefits you have received as a result of this gift if you are to claim charitable contribution deduction; you have received no good or services, or other benefits from St. Joseph Academy in consequence of the contribution acknowledgement.